News

26 June 2017

Plundering Africa (Season 2)

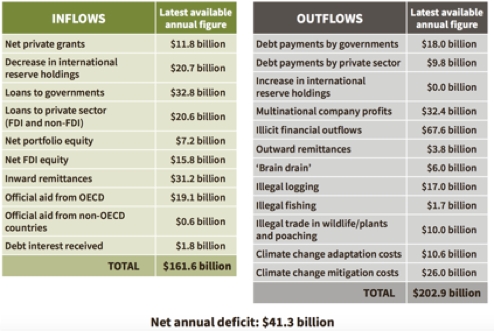

Three years after the publication, in 2014, of a first report on Honest Accounts? The true story of Africa’s billion dollar losses, based on 2012 figures, on which hungerexplained.org commented [read here], a coalition of UK and African equality and development campaigners publishes an updated Honest Accounts 2017 How the world profits from Africa’s wealth, based on the most recently available data.

Like three years ago, this new report shows that Africa (in fact the 48 countries classified as being part of Sub-Saharan Africa, according to the World Bank) continues to see part of its wealth being extracted from the continent and directed towards other parts of the world. Despite the changes observed since the previous study, the figures published in this report confirm that the narrative on Africa, spread by most of the media, that presents it as the continent of poverty, hunger, conflict and crises and a lost case, a basket case that has to be supported by international aid to survive, is utterly misleading. While poverty and hunger, conflicts and crises, there are, rather than being supported by the outside world, it is Africa that funds, in fact, the rest of the world through the flows described in the publication.

The updated flow is however estimated to be less now than three years ago ($41 billion/year now, compared to $58 billion/year then). The main explanations provided for this difference is the fall of raw material prices which have “led to reductions in government holdings of international reserves and lower (but still significant) multinational company profits taken out of the continent. In addition, there are now more loans to African governments”.

The table below shows main aggregates estimates used in the 2017 study.

Looking into the details of the figures presented in the two successive reports, major changes observed are:

-

•regarding inflows into Africa: a total increase of $28 billion, of which:

-

•An increase of inflows resulting from a reduction of international reserve holdings ($20 billion);

-

•An increase of $12 billion of loans to the private sector;

-

•An increase of inward remittences of just above $12 billion;

-

•An increase of loans to governments (+$9,4 billion);

-

•A decrease by $10 billion of Official aid from OECD countries;

-

•A reduction of more than $16 billion of portfolio and FDI equity.

-

•regarding outflows from Africa: a total increase of around $10 billion, of which :

-

•An increase of illicit financial outflows ($32 billion);

-

•A decrease of outflows from a reduction of international reserve holdings ($25 billion);

-

•A decrease of profits of multinationals ($14 billion).

-

These changes illustrate two important points regarding the evolution taking place in Africa:

-

•Despite being a resource-rich continent, an increasing number of Africans migrate outside of the region in order to earn their livelihood, as illustrated by the increase in remittences. This shows that the way in which African wealth is being used does not benefit the great majority of people who have to seek sources of livelihood outside of the region. A clear proof that development taking place in the 48 countries analysed is not ‘inclusive’.

-

•A movement is taking place to fund Africa through Foreign Direct Investments and loans to both the private and the public sectors, rather than through grants or equity. Africa is becoming a new frontier for business, as advocated by the World Bank in 2013 regarding food and agriculture (Growing Africa: Unlocking the Potential of Agribusiness). But it is also likely to be once more the victim of a major debt crisis with Mozambique and Ghana appearing to be the first candidates.

-

•Illicit practices develop fast in Africa as expressed by the doubling of illicit flows of money in three years. The report estimates that illicit flows of money amount to more than three times aid received by the 48 countries analysed.

As in their first report, the authors formulate two key recommendations on what could be done (by rich countries) to change this situation :

-

•Rich countries should act to curb the tax dodging practices of their multinational companies;

-

•Aid should be reconfigured “as ‘reparations’ for the ongoing extraction of wealth and other damage being done. The level should be set at the level of the damage, not some arbitrary rate set by governments out of their own ‘generosity’.”

Unfortunately, the general tone of the report suggests that all the responsibility of the situation observed is with the ‘rich countries’, while many observers believe that the small regional elite is more than just a passive accomplice of rich countries and think that the mode of governance in the region should be reformed in-depth.

Moreover, the flows estimated by the report are limited to actual financial flows and may seem relatively small to some commentators, when compared to Africa’s GDP (around $7,700 billion). The authors entirely overlook the transfer of wealth resulting from an unequal trade, as explained by J. Hickel in a recent article [read here], where transfers from poor countries to rich countries, at world level, are estimated somewhere between 1,500 and 5000 billion!

————————-

To know more:

-

•Curtis, M. and T. Jones T., Honest Accounts 2017 How the world profits from Africa’s wealth, 2017

-

•McVeigh K., World is plundering Africa's wealth of 'billions of dollars a year’, The Guardian, 2017

-

•Wrong, M., ‘The Looting Machine,’ by Tom Burgis, The New York Times, 2015

-

•Sharples, N. et al., Honest Accounts? The true story of Africa’s billion dollar losses, 2014

Earlier articles on hungerexplained.org related to the topic:

-

•Hickel, J., How to stop the global inequality machine, 2017

-

•Plundering Africa, 2015

-

•Le dernier rapport de la Banque mondiale sur l’Afrique: à la conquête de la dernière frontière pour les marchés agricoles et alimentaires…, 2013 (in French only)

You may also want to take a look at other articles in our Africa folder

Last update: June 2017

For your comments and reactions: hungerexpl@gmail.com