Food crises

Download Ukraine_war.pdf

Ukraine war and food crisis: facts and debates

It has been a long time since a food crisis attracted as much interest in the media and played as central a role in the political, diplomatic and military debate as the current food crisis, the last comparable occurrence probably being the 2008-2009 food price crisis [read]. The importance of the event, the impact of which can be felt throughout the world, including in powerful countries, presumably explains why it leads to such contrasting assessments and explanations. It mobilizes divergent theories (some of which with a conspiracist touch) and produces innumerable statements that forget that much of what is happening is neither new nor surprising. Too often, they are distorted by a prism of emotions in which anger, anxiety, hatred, disgust and disbelief induce those who cannot limit themselves to observing or analysing facts fairly and objectively, are carried away and disregard what they may have said a few months or years earlier.

The risk of such an emotionally distorted analysis is that it likely gives birth to a passionate, biased, unbalanced assessment, and to the suggestion of inadequate solutions.

The objective of this article is to try to get a clearer view by relying on facts, and if possible, only on facts.

The facts

Production facts

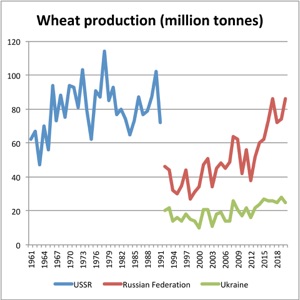

Wheat and maize production in both Russia and Ukraine have followed a remarkable growth in recent years.

In the case of wheat, Russia alone produced as much in 2020 as the whole of the former USSR in the late 1980s. Most of the increased output is due to higher yields, particularly in Russia, productivity in Ukraine being more irregular (Figure 1).

Figure 1: Wheat production and yield

in the Russia, Ukraine and the former USSR

Data source: FAOSTAT

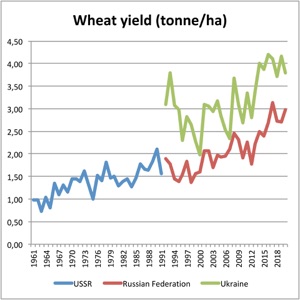

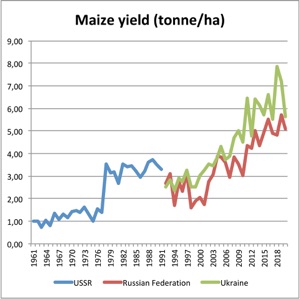

In the case of maize (Figure 2), growth has been even more remarkable, and it is most probably pulled by the development of animal production and by exports. Russia produces now more maize that the whole of the USSR in the 1980s, while Ukraine’s output is more than double. In this case, growth comes as much from yield increase as from area expansion.

Figure 2: Maize production and yield

in the Russia, Ukraine and the former USSR

Data source: FAOSTAT

Trade facts

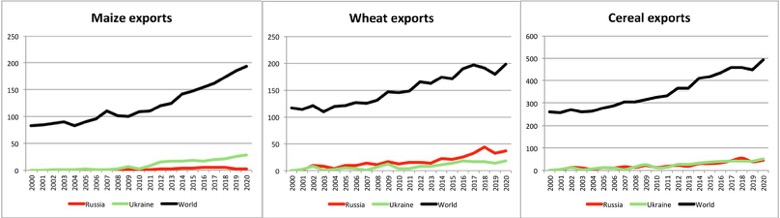

As can be seen from Figure 3, the development of cereal production in Russia and in Ukraine was simultaneous to a remarkable growth of exports, giving these two countries an important role in international agricultural trade. From almost nothing in 2000, exports from these two countries represented 28% of global exports of wheat and 16% for maize in 2020.

When compared to total world cereal exports, Ukraine and Russia weighed 20%. When compared to world cereal production, they only accounted for little more than 3% of the total, as only around 16% of total cereal output is actually traded (26% for wheat, 17% for maize, and much less in the case of rice).

These data should help to place Russia and Ukrainian cereal export statistics in context.

Figure 3: The weight of Russia and Ukraine exports

of wheat and maize (in million tonnes)

Data source: FAOSTAT

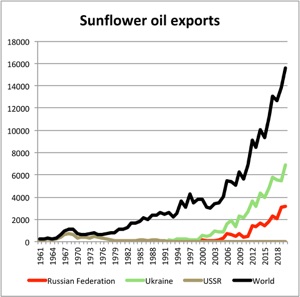

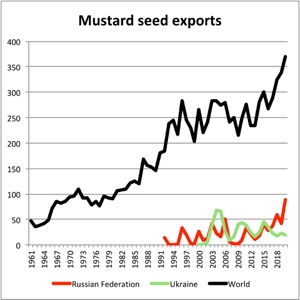

There are two further food products where Russia and Ukraine play a particularly important role on the world market: sunflower oil and mustard seeds. Figure 4 shows that, like maize and wheat, the exports of those two products have followed a remarkable upward trend, especially for sunflower oil where, together, the two countries represented 65% of world exports and more than 50% of global production of seed in 2020. The importance is less for mustard, but still quite considerable (29% for exports in 2020 and between 20 and 30% for output in 2019 and 2020 respectively).

Figure 4: The weight of Russia and Ukraine exports

of sunflower oil and mustard seeds (in thousand tonnes)

Data source: FAOSTAT

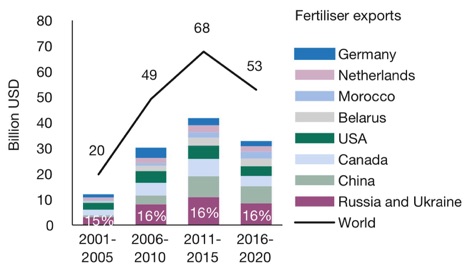

Fertilizer (especially nitrogen fertilizer produced by using the energy generated by gas) is another commodity for which Russia and Ukraine play an important role, as their exports corresponded to around 16% of total trade over the 2015-2020 period, as can be seen from Figure 5.

Figure 5: Global fertilizer exports (2001-2020)

Source: Glauben et al., 2022.

As soon as the war started in Ukraine, fertilizer prices also increased sharply. The fertilizer price index rose by 43% between February 25 and March 25, 2022. This was at least in part explained by Russia’s announcement of export restrictions, but it followed an upward trend since 2020 [read].

Some facts on Russia’s and Ukraine’s trading partners: the case of wheat

The main trading partners of Ukraine and Russia for different food commodities can be seen in Table 1.

Table 1. Trading partners of Ukraine and Russia

for selected commodities

a. Russia

-

b.Ukraine

Data source: FAOSTAT

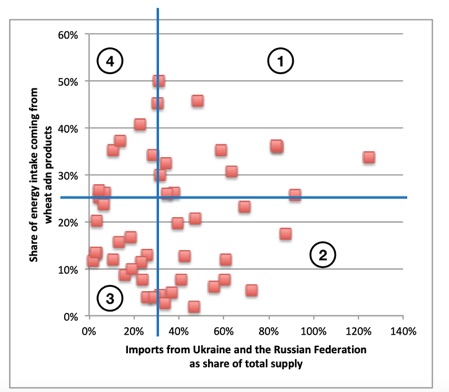

Vulnerability of trading partners can be assessed by considering the share of their imports from Ukraine and Russia, and the importance for them of a particular commodity.

In the case of wheat, the importance is measured by the percentage of caloric intake provided by wheat and related products. By combining this indicator with the share of wheat imports from Russia and Ukraine, it is possible to regroup trading partners into four categories or quadrants defined by two cut-off points (35% for the share of imports and 25% for the share of calories coming from wheat and products, fixing the vulnerability threshold at 0.875 = 0.35*0.25) (Figure 6).

Figure 6: Vulnerability of Russia’s and Ukraine’s

trading partners in wheat and products (2019/2020)

Data source: FAOSTAT: detailed trade matrix and food balances

As a result, the most vulnerable countries placed in quadrant 1 are: Libya (0.42), Georgia (0.30), Lebanon (0.30), Armenia (0.24), Yemen (0.22), Egypt (0.21), Jordan (0.20), Azerbaijan (0.15), Tunisia (0.15), the United Arab Emirates (0.10), Turkey (0.10), Albania (0.10) and Mongolia (0.09).

To this group, one may add Israel (0.16), Congo (0.15), the Sudan (0.10) and maybe Sri Lanka (0.07), on the ground of the very large share of their imports coming from Ukraine and Russia, and Mauritania (0.11) and Morocco (0.09), because of the importance of wheat in their diet, as well as Somalia and Eritrea for which data are unfortunately incomplete or unavailable for recent years.

A word of caution: it is good to remember that vulnerability also depends on the financial capacity of countries to purchase wheat from alternative sources. From this point of view, it is awkward to analyse in the same framework country as diverse as war-torn Yemen or Somalia and Israel or the United Arab Emirates. It is equally important to note that dependency on imports from Ukraine and Russia are not quite equivalent at this point in time, as it is easier for Russia to bring its outputs to the world market, despite economic sanctions, than for Ukraine, whose Black Sea ports are blocked by the conflict.

A similar vulnerability analysis could be conducted for the other food commodities exported by Ukraine and Russia, although from a food crisis perspective, these commodities are probably less strategic than wheat.

The debate in 5 questions and answers

1. Is the use of food as a weapon essentially the result of a strategy adopted by Russian leader Putin ever since he has been in power?

This is what some actors of today’s debate claim. Some emotional, politically oriented or, in some cases, conspiracist statements claim that this is a consequence of a so-called specific Soviet tradition of using famine as a weapon.

This thesis calls for several comments. First, the acceleration of production and yields for both maize and wheat can largely be explained by the changes in economic policy in both Ukraine and the Russian Federation, following the end of the USSR.

In Russia, by 2000, after the economically disastrous 1990s, a proactive policy was implemented aiming at using the country’s resources to restore the historical strength of Russian agriculture and Russia’s agricultural sovereignty. This was made possible by investing profits from sales of fossil oil into the sector and the creation of huge agroholdings or megafarms sometimes linked to large international agribusiness multinationals. The development of agriculture was further eased by an improved access to world markets after Russia’s membership of the WTO in 2012. It also diversified in reaction to Western sanctions and Russia’s counter-sanctions after the annexation of Crimean peninsula in 2014 [read in French]. For example, the development of maize was simultaneous to a remarkable growth of poultry production.

In the case of Ukraine, the evolution of the agriculture sector has been characterized several phases of agrarian reform leading to the domination of large agricultural enterprises and generalization of monoculture. More than 80 of such agroholdings farm around 6 million hectares [read].

The increase of global food prices that took place during the crisis of 2008 and the following price spikes, as well as policy changes in major food producing countries have undeniably created incentives for developing cereal production in the region. In fact, it had been observed that “Reforms of the US agricultural policy and adjustments in the Common Agricultural Policy of the EU have led to a reduction of incentives given to wheat producers in those two economic giants”. This brought about “a change in the centre of gravity of wheat production worldwide, which moved towards Ukraine, Russia and Kazakhstan (the so-called ‘‘Black Sea’’ zone)”. By 2012, it had been noted that “this zone represented around 30% of world production of wheat, and this change of location of wheat production automatically induced more variability in the total quantity traded in the world, and therefore more volatility in wheat prices” linked, in particular to “their specific climatic conditions” [read p. 4].1 It is possible to add today that this variability is likely to further increase because of the impact of climate change.

In other words, the move of the centre of gravity of wheat and maize production towards the Black Sea region has been the consequence of a series of factors, many of which are external to this region. Furthermore, everyone was perfectly conscious of the change that was taking place ten years ago from today. It is therefore an oversimplification of reality to say this was the sole result of a Russian government strategy.

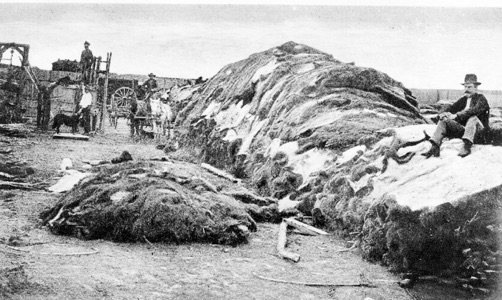

The second comment, is that using food as weapon is not, as often stated in Western media, a Soviet-specific tradition. In fact, food has been used as a weapon for time immemorial.

Mass killings of buffaloes in North America in the 19th century

Sieges and blockades have been widely applied throughout history to create famine and bring about enemy capitulation. The continental blockade of the UK orchestrated by Napoleon in the early 19th century illustrates this kind of endeavour on a large scale, as does the killing of buffaloes to weaken the resistance by the indigenous population during the conquest of North America by European settlers. There are also examples in history when food was used as a weapon against the people by both national political leaders and private industrialists [read]. Undoubtedly, Stalin did organize the massive famine in Ukraine that caused millions of deaths [read], but it is not an isolated Soviet-specific case. It is now occurring in Tigray, according to the UN, and only few media even mention this tragedy [read here and here]. Other examples include Yemen and Syria [read], Somalia, and many more.

In addition, food (including humanitarian assistance) has often been a way to influence the outcome of different types of negotiations and obtain geopolitical allegiance. Sometimes, aid and trade bans on food items have been mechanisms used to try and exacerbate civil tensions with the hope of triggering political upheaval and change, as has been the case in Cuba for decades, in the former USSR at the time of the US grain embargo in the 1980 in response to the USSR invasion of Afghanistan, or in Iran and the Sudan recently. In this case, these economic sanctions, often food-related, have had considerable impact, hitting more the poor and causing loss of lives [read].

The use of food as a weapon is therefore exceptional in the case of the Ukraine conflit, Rather it is a very common - if not generalized - practice.

2. Is the current hike of food prices exclusively due to the invasion of Ukraine by Russia?

The illegal invasion of Ukraine by Russia is certainly a major cause of increased food prices. However, it is only one among several others.

Indeed, the current price hike cannot be put wholly on the account of the Ukraine conflict. In fact, real food prices had started to move upwards by early 2020, more than two years before the start of the Ukraine war, and they achieved prices comparable to and above those seen in 2008 and 2011-2012 as early as in May 2021 for vegetable oil and for the general index in August/September 2021 (Figure 7).

The major explanation of the increase of food prices starting from 2020, is that they were pushed upwards by the leap of fossil energies (oil and gas) prices when China’s economy recovered after the first wave of the COVID-19 pandemic.2 This energy price hike caused higher production costs in agriculture (more expensive fertilizer and fuel) and it encouraged the use of food commodities for manufacturing agrofuels. This latter link between food and energy increases demand for maize and oilcrops as soon as energy prices raise, particularly in the US and the EU, thus contributing to a surge of food commodity prices. This is especially true in the EU for vegetable oil prices, as around 11 million tonnes of vegetable oil is used as fuel, an amount that is equivalent to 45% of the total use of vegetable oil in the Union [read in French].

Figure 7: FAO’s real food price indices (1990-2022)

(2014-2016=100)

Data source: FAO

In addition, there has been a tendency to keep low stocks, thus increasing vulnerability to various types of shocks (e.g. drought, disruption of trade because of conflict or accidents blocking key trade routes, as was the case in the Red Sea in 2021). Vulnerability is also the result of the reliance on just in time supply, in order to reduce storage costs. It is equally induced by WTO rules regarding the holding of public stocks.

Finally, financial speculation on prices is often accused to be a cause of price spikes, or at least to be responsible for amplifying price movements. However, there is no consensus on the actual role of financial speculation. What is clear, nevertheless, is that, since the beginning of the war in Ukraine, there are indications that there has been a considerable increase of financial flows mobilized for speculating on food prices [read] and that future prices of wheat have made a jump, shortly after the start of the war, that some analysts see as being non-commensurate with the importance of the volume produced and traded by Ukraine and Russia [read].

All these factors have contributed to increase the speed and magnitude of changes in prices.

3. Could the disruption in cereal supply caused by war in Ukraine be compensated from other sources?

To reply to this question, is important to make a distinction between the short-term and the medium- to long-term.

In the short-term, many commentators claim that the main problem is to get last year’s production out of Ukraine to make space for the new crop to be harvested in the coming weeks, and to proceed with the harvesting (this could be difficult because part of the workforce is directly involved in the war, insecurity prevails on a large part of Ukrainian territory and, possibly, because of shortage of fuel).

Wheat. Based on data from the Ukrainian Agricultural ministry, wheat exports for the last season stood at 18 million tonnes as of the day before the start of the Russian invasion. Assuming that only a small additional quantity could have been exported since - and this is plausible (because of non-functional supply chains, destruction of transport and storage infrastructure, road blocks, etc.), some think that around 6 million tonnes of wheat could still be in stock. Similarly, in the case of Russia, there should be near to 10 million tonnes left for exports that may or may not occur, depending on reluctance of buyers to expose themselves to sanctions as well as logistical, financing and insurance constraints [read]. As a result of sanctions, the US Department of Agriculture expects Russian wheat exports to fall by 8.6% (3 million tonnes) below initial forecasts [read].

Maize. Based on Ukrainian government data, maize exports stood at 19 million tonnes on February 23, leaving an estimated stock of 15.5 million tonnes [read].

Others believe that most of the past harvest has already been exported and only around 4 to 5 million tonnes of maize are left in stock [listen in French].

Given the volumes involved, there is a general feeling that, despite greater market tensions, there will be no physical shortages for wheat supply as, in the short term, global demand for wheat could be met by an increase of exports by Australia, Brazil and the US [read], although at a higher price, both because the price of cereals might still increase, and because of record shipping costs set to more than double compared to what they were in January and are unlikely to normalize before 2023 [read]. Egypt, for instance, has already been looking for alternative sources of wheat by talking to Argentina, France, US and India [read], but since then, in May, India imposed a ban on private (not public) wheat exports [read].

No shortage, but high prices and quite probably serious difficulties for the poor to purchase their food, for lack of financial resources.

In the medium- and long-term, there are risks of reduced cropped surface in both countries, in Ukraine because of lower labour availability (due to mobilization and population displacements) and agricultural inputs, insecurity and mines, and in Russia, as long as export prospects seem unfavourable because of sanctions and/or counter sanctions.

Considering that the cereals exported by Ukraine and Russia represented around 3% of total cereal production (approximately 100 million tonnes in 2020), compensating them from other sources is not simple, but possible.

Three main options are available: expansion of area cropped in cereals (this is being envisaged in the EU and in the US, for example), reducing the volume of cereals used for producing agrofuels (this would require a change of policy of those countries subsiding agrofuel production and of regulations favourable to their production) and for feeding animals (particularly poultry and pigs). The first two of these options have some drawbacks in terms of their potential negative impact on climate change and biodiversity (a topic on which there is no real consensus), while the third would imply an acceleration of the nutritional transition towards diets involving less animal proteins.

It is clear that if this compensation cannot be made and if the conflict persists, this situation will have negative impacts throughout the world, including on food insecurity.

4. What could the major impacts of the current crisis be?

Vulnerability of Ukraine and Russia’s trading partners has already been emphasized earlier. They are the most directly affected.

However, the impact of the conflict is also felt in countries that are not importing (or import very little) from Russia or Ukraine, but where wheat is an important staple food. This is particularly true for wheat-importing countries such as Turkmenistan and Iran where wheat is the main staple food [read], because of the price effect of the crisis is felt worldwide. This also applies to consumers (especially the poor) living in all other countries where wheat is prominent in diet, as domestic prices of bread and wheat-based products have been rising everywhere.

This situation also has a macroeconomic effect on inflation and debt in wheat-importing countries and on food insecurity. Agricultural production is likely to be affected, because of the greater difficulty to have access to agricultural inputs [read].

It is important to mention here that high food prices are not, in principle a bad thing, Indeed, food prices generally do not reflect the real costs of food [read] and their level encourages food wastage [read]. It has been estimated that, for contributing to more sustainable food systems, food prices should be approximately 30% higher than what they are on average [read]. Evidently, it goes without saying that such higher prices would require a commensurate adjustment of salaries and corresponding additional support to the poorer population groups,

5. What are possible solutions?

Some have already been mentioned above:

-

•Expansion of area cropped in cereals (this is being envisaged in the EU and in the US, for example);

-

•Reducing the volume of cereals used for producing agrofuels. In Europe that would mean removing the obligation of a minimal agrofuel content in fuel sold to consumers and either ban their use altogether or at least apply a maximum cap on the share of agrofuels allowed. This policy, supported by the removal of subsidies on agrofuel production, would free up to 140 million tonnes of maize only in the US [read in French];

-

•Diminishing the quantity of cereals used for producing animal proteins;

-

•Reform WTO rules on public stocks by allowing:

-

•To make Japan’s rice stock virtual and sell the volume of mandatory purchased rice if the price is higher than a predetermined threshold;

-

•Greater freedom for countries wishing to make food security stocks during periods of low food prices [read in French].

-

Others include:

-

•Providing assistance to population groups lacking resources, to ensure that their food needs are properly met;

-

•Implementing programmes to change in dietary habits to reduce consumption of imported foods in favour of consumption of food items that can be produced locally, and replace animal proteins by plant proteins. This will take time and should rest on priority action on children to develop new dietary habits, e.g. through school meals;

-

•Promoting locally produced organic fertilizers and other soil fertility management techniques, for reducing dependency on imports of synthetic fertilizers;

-

•Reinforcing national and regional food reserves to be more effective in responding to shocks [read], and, last but not least;

-

•Peace (although other factors pushing prices up would remain once the war in Ukraine is over).

Conclusion

A few words of conclusion can be drawn from this analysis:

-

•The war in Ukraine is only an accelerator of a preexisting food crisis resulting from multiple causes;

-

•One should guard against simplistic explanations full of ideology and sometimes conspiracism, that verge propaganda;

-

•Food has been used as a weapon throughout history in countless cases by very diverse actors;

-

•There are solutions to reduce the impact of this crisis in the short, medium and long term, the least not being to negotiate the end of the conflict or, at least, meanwhile, to find ways to avoid its worse consequences;

-

•Among these solutions, there is the modification of food habits. Luckily, these changes can also contribute to the transition towards more sustainable and climate-friendly food systems.

The current crisis should be an opportunity to reflect seriously and draw lessons so as to better understand the changes to be brought to our food systems to prevent this type of event in the future and to make them more sustainable and climate-friendly.

(June 2022)

---------------

Notes

-

1.It is also important to mention here that this region is charaterized by the presence of Chernozems (black soils) which are particularly fertile and rich in organic matter that provides it with a very high moisture storage capacity [read].

-

2.The increase of energy prices was the result of a period of low investments in the oil sector that followed the oil price drop observed after 2014.

—————————

To know more

-

•Chandrasekhar C.P. and J. Ghosh, Why are Global Wheat Prices Rising so much? 2022.

-

•FAO, Impact of the Ukraine-Russia conflict on global food security and related matters under the mandate of the Food and Agriculture Organization of the United Nations (FAO), Hundred and sixty-ninth Session of the FAO Council, 2022.

-

•Galtier, F., Nous pouvons (et devons) stopper la crise sur les marchés internationaux, Fondation pour l’agriculture et la ruralité dans le monde, 2022 (in French).

-

•ECOWAS, FAO and WFP, Assessment of the Risks and Impact of the Russian- Ukrainian Crisis on Food Security in the ECOWAS Region - Key Findings, 2022.

-

•IPES-Food, Another Perfect Storm? Interntional Panel of Experts on Sustainable Food Systems, 2022.

-

•Dufy, C., Facteurs et limites du retour de la superpuissance agricole russe, Les études du Centre d’études et de recherches internationales, Centre de recherches internationales de Sciences Po (CERI), Regards sur l’Eurasie. L’année politique 2020, pp.48-53, 2021 (in French).

-

•Kutsmus, N. et al., Agricultural development in Ukraine: institutional changes and socio-economical results, Zhytomyr National Agroecological University, 2017.

Earlier articles on hungerexplained.org related to the topic:

-

•Opinions: Sanctions Now Weapons of Mass Starvation by Anis Chowdhury and Jomo Kwame Sundaram, 2022.

-

•COVID-19 and food crisis: the main operating mechanisms, 2020.

-

•Food crises: A consequence of disastrous economic policies, 2012.

Last update: June 2022

For your comments and reactions: hungerexpl@gmail.com