Power in food systems

Private economic power in food systems and its new forms

Private power and market shares: the horizontal dimension

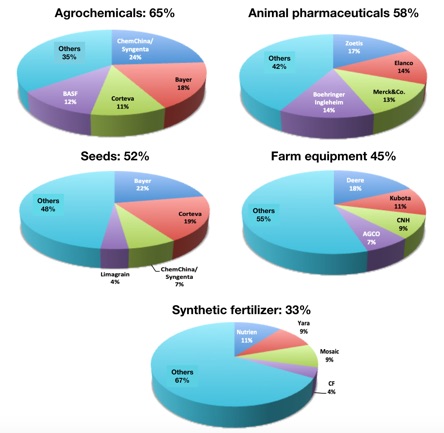

Until very recently, private power distribution in food systems - and in other sectors of the economy - was measured mostly on the basis of “market shares” that businesses were able to capture: the greater the part, the more the company was considered as powerful. The level of concentration of firms in a particular sector was therefore often estimated by computing the “CR4”, the market share of the four biggest companies in the sector.

Fig.1 gives the CR4 for seeds, agrochemicals, farm equipment, synthetic fertilizer and animal pharmaceuticals.

Fig.1: Concentration in the agricultural inputs sector (2020)

Source: Hendrickson et al., 2020

download picture: Market_shares.png

This way of considering private power in food and agriculture tends to lend a prominent role to the market and to market transactions: having large market shares gives an economic weight that confers a strong economic position, compared to competitors. This vision encourages the study of economic agents operating in a specific domain (seeds, fertilizer, equipment, etc.) as can be seen in Fig.1.

Having large market shares also provides a strong position to a business with respect to clients (downstream) and suppliers (upstream) when there is a need to negotiate the terms of an exchange. In this case, the emphasis is given more to the relations existing among firms operating in different sectors, but interacting through market transactions within a particular product or group of product value chain (wheat, apples, cocoa, milk and dairy, etc.).

When a market is characterised by the domination of a small number of large businesses, it is expected to be less competitive and collusion may occur among these giants that could enable them to capture some kind of rent by imposing prices of the goods they buy or sell. This is the pattern in the domain of agrochemicals or seeds, where a small group of huge companies interact with hundreds of millions of farmers, or when farmers sell their fresh products to a few large retailers sufficiently strong to enforce unfavourable terms (price, quality, delivery volumes and deadlines, etc.).

It is precisely in order to be stronger when dealing with their suppliers or buyers that farmers created cooperatives that, for example, represented close to 40% of agricultural production in the European Union, and around 30% in the US, at the beginning of the second decade of this century. To be stronger, these cooperatives often regrouped processing and marketing activities together with primary agricultural production [read].

It is in this context that supermarkets emerged, at the time when agriculture was becoming more industrial. Supermarkets gained a strong position starting from the middle of last century, first in the US, and then progressively throughout the world, including in middle-income and poor countries during the 1990s. On the other hand, industrialisation of agriculture brought about a high concentration of mass production, particularly in the framework of megafarms that may control tens - sometimes hundreds - of thousands of hectares and up to a million animals [read].

Centralised purchases, innovation in logistics, imposition of norms and standards, use of contracts with farmers allowed supermarkets to improve their competitiveness, suppress progressively a large part of preexisting retail businesses and reduce consumer prices through cuts in margins compensated by larger volumes of sales, thus accumulating considerable profits.

Power of producing and enforcing norms: the vertical dimension

Supply chains that go from field to fork have existed for time immemorial. With growing urbanisation and the development of international trade, spectacular changes occurred in food value chains. On the one hand, they became much more complex, with a multiplication of the stages completed by a product (primary production, collection market, wholesale market, storage - including cold chains -, successive processing and retail), and on the other, they turned international, as various stages can now be located in different parts of the world. They also became increasingly financialised, encouraged by the liberalisation of trade and investment.

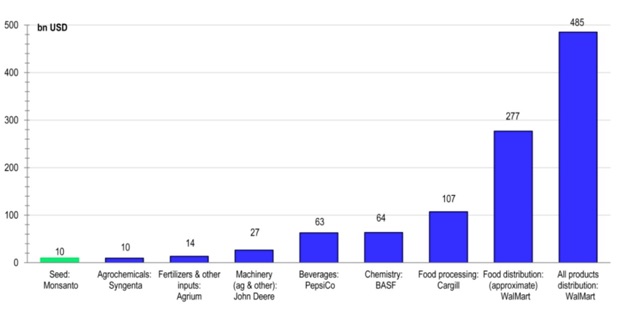

In this new generation of value chains, agents coexist that have very diverse economic and financial weights which, of course, impact on the balance of power among them (Fig.2). The huge size of retail giants, for instance, certainly explains largely the dominant role these companies are now playing in the global food system.

Fig 2.: Size of the largest company of each sector in the agri-food chain

Source: Bonny, 2017

download picture: Bonny.png

The size of the turnover of firms is, however, not the only factor explaining the importance of their role. Norms and standards constitute another source of power.

In increasingly international food value chains, the influence of government has been reduced, particularly regarding the formulation and implementation of norms. They can act on their own territory, of course, and they also take part in the elaboration of international food quality and safety standards in the framework of FAO’s and WHO’s Codex Alimentarius.

However, over the last several decades, norms designed by private businesses have gained importance. They are developed to cope with regulations, but also to meet requirements of consumers and to make it possible for firms distinguishing themselves from their rivals by acquiring more competitiveness through better food quality and safety on markets of high-value food and agricultural products [read].

The criteria used for defining these norms include the production process (e.g. organic food, animal welfare, remuneration and safety of workers, impact on the environment), as well as the level of presence of some items known to be dangerous (fat, sugar, salt, pesticide residues, antibiotics, colours and additives, etc.).

The emergence of these private standards has been supported by the development of codes of conduct and quality systems, whose implementation is at the centre of vertical governance of food chains and cuts across several successive markets. It gives considerable power to the lead firms prescribing and controlling them over other agents operating along the food chain, from primary agricultural production to retail.

Lead firms, invested with a new form of economic power, often drive innovation and product differentiation, and fix the terms of participation in the chain [read]. Touted as a source of improved efficiency, competitiveness, and match with requirements of consumers, the architecture responsible for private certification is also the object of many criticisms regarding its transparency and efficacy [read].

It is in this context that holding information has become a crucially important factor. This information includes insights into the requirements and preferences of consumers, and data pertaining to the production and other processes implemented by agents operating at various levels of the value chain.

Struggle for power, rather than limited to the market share held by firms on a particular market, has shifted increasingly towards their capacity to collect, process and analyse real-time information on what is happening in different parts of the value chain of a given product. The objective then becomes not so much to dominate one stage in the chain as to control its totality and acquire the power to include or exclude agents that respect or do not respect current standards (and the authority of the lead firm that governs them). Evidently, this system helps the lead firm increase its market share at the final stage of consumption.

The power of information: digital technology, control of access and attention economy

The digital revolution and the huge means for collecting, processing and analysing data it generates is reshaping agri-food systems [read].

Its emergence creates capacity to centralise in one place (in one firm) extremely detailed, diversified and localised information: on soil and meteorological conditions, on animal and plant health conditions in individual farms, on available and implemented technologies, on food and agricultural inputs consumed by a specific firm, on market situation, on needs and preferences of clients, etc. It then becomes possible to use this information to govern to the last detail what is happening (or should happen) in a given value chain. Digital technology enhances the capacity and resolution of control and command the lead firm exercises on other agents. It also strengthens its power of exclusion of a particular agent (including an individual farm) that would not respect required specifications [read], while raising serious issues of data security and ownership.

This revolution was accelerated by the COVID-19 pandemic that has pushed businesses as well as consumers to make greater use of online or “click and collect” purchases [read here and here]. It leads to the emergence of new companies or the entry into the food and agriculture sector of digital firms (Amazon or Microsoft, for example, to name just two among the best known). It also induces well-established businesses to expand outside of their usual field of operation, with the view to be better placed in the governance of agri-food value chains.

Another remarkable impact created by this technological change is that power is no more necessarily the consequence of the size of firms or their financial sway. Controlling information has turned into an increasingly crucial factor. Thus, it is interesting to note that digital platforms are formidable engines of innovation, much beyond their economic weight, if estimated in terms of the value added they generate. Their power comes from disruptive and innovative business models that bring about a spectacular reduction in transaction costs challenging traditional markets [read]. It is difficult to foresee, today, how far this trend will go.

Related to this aspect, another major characteristic of this revolution is the advent in the food sector of attention markets and multi-sided platforms, as well as new business models in which the source of profits is increasingly disconnected from physical production processes. Three examples illustrate these changes, the effects of which can now also be felt in the domain of food.

The attention economy seeks basically to capture consumer interest. For this, various means are used. One takes to extremes the notion of loss leader: the zero price effect. This effect comes from the fact that demand for a good or service whose price is very low, increases significantly if it is made available for free (at zero price), because consumers perceive the benefit drawn from this good or service as much higher than the savings they make [read]. Such goods or services therefore strongly attract the attention of consumers and boost site traffic, thus raising the value of the firm managing the digital platform.

The other uses multi-sided platforms that are platforms that allow digital companies to enter new markets, increase and diversify the goods they sell and create links among markets that, in the real world, operate in very different domains. In this case too, there is some resemblance with what hypermarkets have been doing by mixing in the same spot products of very different nature and use. In multi-sided platforms, however, the digital firm is hardly involved in the production process or even in the value chain, as it just does the job of connecting potential buyers with businesses that have something to sell. Thus, it occupies the strategic point where links between consumers and companies are managed, and it imposes itself as an indispensable intermediary, a position that gives it the possibility of extracting excessive profits and fix unfair terms and conditions to subscribing business partners [read].

Finally, it is important to know that for digital platforms, revenues from sales do not constitute the main source of profit. Attention markets (e.g. income from publicity) and asset valuation (linked for example to data collected) are more critical, which explains why these firms can see their value grow, when profits from sales stagnate and even fall.

(Provisional) conclusion

The various forms of power that have just been reviewed coexist and overlap in the food system today. This makes it quite difficult to take stock of power distribution among firms that are active in it. Market share and turnover remain important indicators, of course, but governance of norms, control of information, attention and new business models arising from the development of digital technologies are playing a growing role, more challenging to assess, that disrupts the widely accepted and somewhat simplistic and outdated image of how power is shared. It is indeed rather difficult to have a clear idea of the combined effect of all these forms of power.

Nowadays, increasingly, power resides less in the capacity to compete on markets, to influence others’ behaviour or obtain a favourable outcome from a bargaining process, or even to exclude rivals from a market, than in the ability to attract consumers and businesses to a particular platform, create new products or cause scarcities, and make both clients and businesses cooperate willingly by offering them something indispensable (e.g. access to potential clients or vital information on their specific interests or behaviour). A possible sign of this power could be, among others, the number of direct relations established with companies and the number of clients attracted, as well as the capacity to observe other players without them knowing, and to learn better and faster than anyone else [read].

One of the major concerns that this raises, in a changing and complex situation, is the nature of an effective regulation able to avoid that food systems fall under the control of a small number of overly powerful firms.

(January 2022)

—————————————

To know more:

-

•Lianos I, and B. Carballa, Economic Power and New Business Models in Competition Law and Economics: Ontology and New Metrics. CLES Research Paper Series 3/2021. Centre for Law, Economics and Society (CLES), Faculty of Laws, UCL London, 2021.

-

•Hendrickson M.K., P. H. Howard, E. M. Miller and D. H. Constance, The Food System: Concentration and its impacts, A Special Report to the Family Farm Action Alliance, 2020.

-

•Tortia, E. C., Valentinov, V. L. and C. Iliopoulos, Agricultural Cooperatives, Journal of Entrepreneurial and Organizational Diversity, Vol. 2, No. 1, pp. 23-36, 2013.

-

•Henson, S., The Role of Public and Private Standards in Regulating International Food Markets, Department of Food, Agricultural and Resource Economics University of Guelph, 2006.

Selection of past articles on hungerexplained.org related to the topic:

-

•Responsible businesses or greenwashing? The certification industry in support of multinationals, 2021.

-

•The digital revolution in food and agriculture - Exciting promises, mixed results and risky bet, 2021.

-

•Opinions : Struggle for the Future of Food, by Jomo Kwame Sundaram, 2021.

-

•The large multinational corporations in charge of our agri-food system...: upstream corporations, 2014.

Last update: January 2022

For your comments and reactions: hungerexpl@gmail.com